Traders and customers have been gathering at Brussels Wharf each Saturday for half a decade to sell, shop, eat, drink, make merry and meet

Subscribe to our free Wharf Whispers newsletter here

“The best thing about running Wapping Docklands Market is being able to connect people in a world that’s more and more isolated,” said Will Cutteridge, founder of The Market Network.

“It’s also having the ability to offer grassroots enterprises access to audiences and to get that instant feedback.”

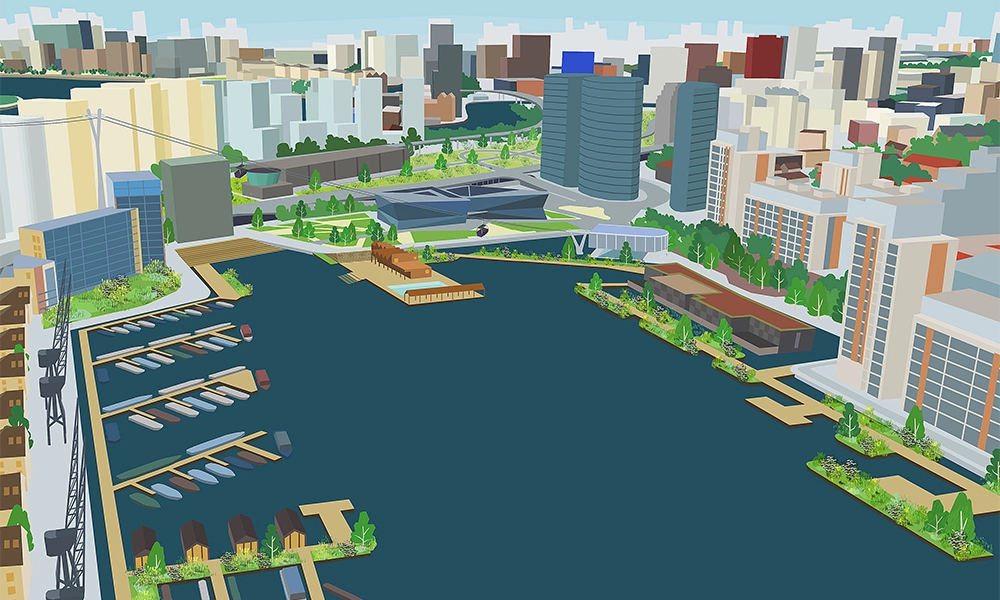

Brussels Wharf was, in 2020, a disused car park – an irregular pentagon of earth, cobbles and quayside jutting out into Shadwell Basin, nominally described as a park.

But Will, having spent half a decade learning the ropes of commercial real estate before leaving that world to sell cheese on a market stall, saw an opportunity – a site that might be put to better use.

Wapping Docklands Market opened in 2021 and is now set to celebrate its fifth birthday in April, 2026.

There might even be a cake.

creating a community

“The thing that’s really great is the community we’ve got here – the regular customers who come back week to week– that’s what really keeps us afloat,” said Will.

“They just happen to be lovely people, and it’s a nice place to be every Saturday.

“We have evolved over the years but hot food – which has always been the primary driver for us – has become more popular and we have live music and a pop-up pub.”

As we talk, pleasant jazz wafts over the assembled crowd played by gentlemen in attractive woollen hats.

Tables and benches are full despite the 6ºC February weather, with visitors keeping out the chill with toasty dishes from the food traders and mulled cider from the bar.

On the lower level of the site, traders sell fresh produce, plants and crafts, adding to the mix.

“It’s morphed over the years – we have up to 12 hot food vendors in the summer months and eight in winter,” said Will.

“One of our mission statements is to empower new and small food enterprises and, as we move towards spring, we typically get a lot of new businesses applying for pitches.

“Firstly what we’re looking for is passion – a reason that someone is doing what they’re doing that isn’t the money.

“Our newest food trader is Tito Vito serving Bocadillos, filled baguettes from the Canary Islands.

“Vito was persuaded by his partner because of his passion for cooking – she’s good with graphic design and created a brand for the business – and you could tell from day one that the food was amazing, that this was something he’d always wanted to do.

“That’s what we’re looking for.

“Then there’s Bahaa, a Syrian refugee who, along with his mother, runs Sojok.

“He serves up toasties filled with spiced minced meat and a savoury yoghurt drink called ayran on the side, which is made with water and salt.

“When he first started, he wasn’t doing so well but he’s evolved his product over time because he knew the market was busy so it was something he was doing that needed changing.

“Now when he’s not at the market, people ask where he is because the stall is so popular.

“My advice is to dunk the toastie in the drink – you won’t regret it.

“It’s also always a good tip, if you’re struggling to decide what to have, to know what the staff on the market enjoy for breakfast.”

access to the Wapping Docklands Market audience

Community is really at the heart of everything Will does, ably supported by long-term operations coordinator Fabiana Da Cunha.

Together, they provide the foundation, marketing, support and curation that allows Wapping Docklands Market to continue, providing a platform for commerce, employment and interaction.

“It’s such a good feeling when you’re able to offer people with passion a way to get access to an audience,” said Will.

“I’ve learnt over the last five years that it’s unbelievably hard to run a business but also not to get so stressed and that everything will be fine.

“It’s really great when we see familiar faces coming here or when you spot people who meet at the market and then are back three weeks later having a beer together.

“We’re giving people the chance to get out of their houses and talk to each other.

“These are things that are important in the world and I wish we could do this more, in more places.

“We’re generating opportunities for new businesses, with our traders often living locally and we’re employing people.

“We have a 17-year-old working for us who lives locally and gets the London Living Wage because we believe that’s the right thing to do.

“We also pay our musicians, who need opportunities to play because venues are cutting live entertainment at the moment.”

Will’s journey has not been without its headwinds.

Operating markets can be a precarious business with limited security on short licences, predicated on the whims of landowners.

Wapping’s sister operations at Tower Hill and Canada Water have both closed, the former in favour of a Padel Tennis court and the latter due to a licensing dispute.

With the late winter sun beating down through the bare branches of the trees, finely crafted improvisation stealing over the crowd and traders serving queues of eager diners, it seems perverse not to support such endeavours.

key details: Wapping Docklands Market

Wapping Docklands Market is open on Saturdays from 10am-4pm at Brussels Wharf on the edge of Shadwell Basin.

The location is around seven minutes’ walk from Wapping station on the Windrush Line or about 10 minutes from Shadwell DLR.

Find out more about the market here

Read more: How SWR Business Direct delivers on carbon tracking for train travel