Banking giant’s plans for the Riverside South site build on foundations laid 17 years ago beside the Thames in east London

Subscribe to our free Wharf Whispers newsletter here

The London Standard recently published a piece entitled The Remarkable Story Of Canary Wharf’s Renaissance.

Amid a series of somewhat confused bird-based metaphors, it tells a tale of a district brought to the brink of disaster by the pandemic and the home working trend that followed it.

It’s boisterous copy is full of “shaky foundations” bonds in “junk territory” and “symbolically damaging” moves.

Scary stuff, but also – like a lot of the analysis that caused some to temporarily lose confidence in the Wharf – it fails to appreciate the silliness of short-termism when considering changes in the area.

This isn’t rebirth, it’s a constant process of reinvention and growth.

It’s nothing new, either.

a big deal

It should come as absolutely no surprise whatsoever that JP Morgan Chase has decided Canary Wharf is the right place for it to build a £3billion tower, providing 3million sq ft of space for up to 12,000 employees.

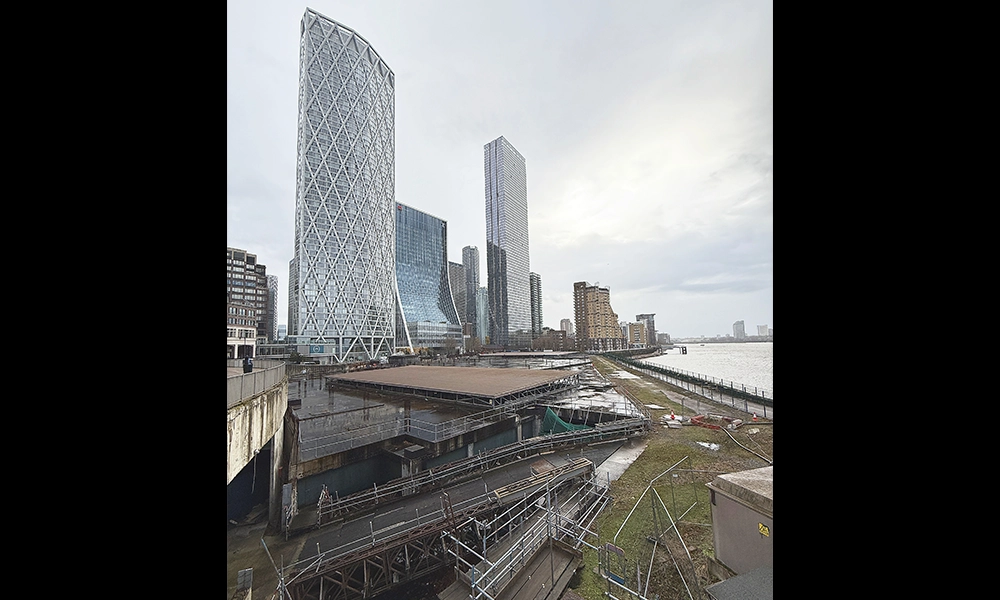

In 2008, the banking giant completed the purchase of a 999-year lease on land beside the Thames for its Riverside South scheme.

The plans drawn up by architects RSHP (then Richard Rogers Partnership) were for two towers.

The size of the scheme? A little over 3million sq ft of space.

Serious work started on the site, adjacent to Westferry Circus, with foundations created and concrete poured for basement structures.

But work stopped in 2010 with JP Morgan opting instead to move into 25 Bank Street – Lehman Brothers’ former home in London.

Wharf watchers will have noted that the Riverside South site has since lain dormant, rebar carefully marked with little high-viz hats and voids protected with temporary roofing.

In 2015, having settled into its new home, JP Morgan nevertheless put plans to sell the land on hold, leaving the option open to develop it later.

A decade on and the bank’s need for space has grown beyond its current accommodation.

This has prompted it to let space at a refurbished building in nearby Cabot Square, which was vacated by Credit Suisse following its enforced takeover by UBS.

A more permanent solution was desired and options were considered.

The bank recently unveiled its new HQ in New York.

That megastructure was designed by Foster + Partners and the bank has now revealed that it has chosen the same architects to take forward plans for its new London office.

Where? On the land it’s kept on its books for the past 17 years.

The project is expected to contribute £9.9billion to the UK economy, with completion in around six years’ time.

Jamie Dimon, chairman and CEO of JP Morgan Chase, said: “London has been a trading and financial hub for more than a thousand years, and maintaining it as a vibrant place for finance and business is critical to the health of the UK economy.

“This building will represent our lasting commitment to the city, the UK, our clients and our people. The UK government’s priority of economic growth has been a critical factor in helping us make this decision.”

Shobi Khan, CEO of Canary Wharf Group, added: “We are delighted that JP Morgan Chase has once again chosen Canary Wharf as its primary UK location.

“The scale and ambition of this scheme – set to become the largest office building in London – demonstrates the continued momentum behind Canary Wharf’s evolution and the bank’s commitment to outstanding workplaces.

“2025 will be our best leasing year in over a decade. Five of the top global investment banks are located at Canary Wharf.”

In the context of a millennium, 17 years doesn’t really seem all that much time to wait…

words matter

CWG is spot-on when describing the way the Wharf has changed over the years.

The project to transform derelict docks into a hive of activity and prosperity has constantly twisted and turned.

Wood Wharf was originally conceived as an office-led expansion of the existing scheme, only for residential towers to rise instead.

The idea that the area has been reborn fails to recognise the granular diversification of an estate that now services the needs of workers, residents and visitors passing through for a multitude of reasons.

The financial services institutions sit alongside life sciences, government, parts of the NHS, digital banks, charities and educational organisations as well as an ever-growing retail and hospitality offering.

There’s even a whale made of ocean plastic and a theatre.

This isn’t coincidence. It’s an area unafraid to act on opportunity, to try new things but, crucially, to put in solid foundations to start with so that when the world needs it to be a different shape, it has something firm to build on.

recent successes

In some senses, Riverside South’s foundations are a decent metaphor for what’s happening to Canary Wharf right now.

Buildings have a shelf life and organisations’ needs evolve.

Challenger bank Revolut went from a handful of employees to hundreds and now thousands, recently landing on the upper floors of the YY London building, a structure extensively refurbished and renamed after the best part of three decades housing Thompson Reuters.

This process of renewal, reinvention and so evolution is going on across the Wharf, most obviously with Citi’s decision to retool its east London home and spending billions of pounds to do so.

There are many other projects in the pipeline, with the value evidenced by Blackstone’s decision to put its Cargo tower back on the market following a refurb and the upturn in perceived value with a slew of businesses opting to move to the Wharf.

The recent wins for the estate are too numerous to list fully but include challenger bank Zopa at Wood Wharf, which recently moved staff in, and the announcement that Visa will relocate its European headquarters from Paddington to One Canada Square.

With 76million people expected to have visited the estate in 2025 and a backdrop of surging demand, it’s little wonder the Qatar Investment Authority, which owns the tower HSBC is set to vacate in 2027, is considering retaining a higher proportion of office space in the structure when it tackles that refurbishment.

Having continued a relentless programme of growth and improvement across the estate, Canary Wharf is arguably better placed than ever before to welcome organisations looking for smart new homes, not least because of the Elizabeth line.

Suddenly, a new ferry with a bigger capacity between Canary Wharf Pier – next to Riverside South – and Rotherhithe looks like a very timely introduction from Uber Boat By Thames Clippers.

Read more: Orbit Clipper begins carrying ferry passengers between Rotherhithe and Canary Wharf