Canary Wharf Group’s Tarun Mathur on HSBC taking new space and how the estate is now a place for everyone – workers, residents and visitors

Subscribe to our free Wharf Whispers newsletter here

Change is a constant.

Three and a half decades ago, no major international businesses called Canary Wharf home.

Since then, the towers built as part of the area’s regeneration from derelict, unused docklands have attracted and housed a vast range of companies and organisations.

Predicting the demise of an area is a fertile activity for the generation of column inches.

However, it’s perplexing – at best – that the confident prophets of decline failed to spot the solid foundations the Wharf’s success over the last 25 years has been built on and the growth and strengthening of that infrastructure that has taken place more recently.

In reality there has been no pause in the Canary Wharf project.

Wood Wharf continues to attract new residents and businesses and North Quay with its vertical wet labs is also in the pipeline.

The latter is particularly significant for the ongoing diversification of the estate’s tenants.

While some firms have decided to move, this might sensibly be seen as natural churn in an area that other companies are increasingly eyeing as an attractive option.

Barclays, Fitch and Morgan Stanley have all recently recommitted to the estate.

BBVA and Smartest Energy have both expanded their presence, while the likes the Bank Of London And The Middle East and McLaren Construction Group have arrived.

It’s also a time of renewal, with refurbished and reimagined spaces frequently preferred to relocation away from the Wharf.

Citibank is currently refreshing its headquarters in Canada Square, while Revolut – once a handful of employees at the estate’s tech community, Level39 – has claimed the upper levels of YY London, a freshly renovated building right outside the Jubilee line’s main entrance.

With JP Morgan outgrowing its 25 Bank Street building and taking space in Credit Suisse’s former block, recent reports suggest the banking giant is looking seriously at restarting a project to build new towers on the western edge of Canary Wharf overlooking the Thames at Westferry.

Then there are other incomers including challenger bank Zopa, Hershey’s, Hexaware, hVIVO and AviadoBio.

Did I mention Visa is also reportedly seeking space at One Canada Square?

All-in-all it’s proving to be something of a vintage year for leasing on the estate – especially given HSBC’s decision to rent some 210,000sq ft of space in Canary Wharf at 40 Bank Street making its relocation to the City in 2027 only partial.

HSBC retains a Canary Wharf presence

“It’s a real endorsement of what we’ve done over the last few years,” said Tarun Mathur, director, offices at Canary Wharf Group.

“That’s not just in terms of the quality of our buildings, but also the environment and the value that HSBC clearly sees in what’s being delivered here for their employees going forward.

“It’s been a fantastic year, with over 450,000sq ft of transactions – this is the strongest 12 months we’ve had for a decade – and a lot of that has been driven by existing customers expanding as well as new entrants.

“Digital bank BBVA, for example, did a major review of where they wanted to be, which focussed on Canary Wharf vs the City for their expansion.

“For them, it was about value and amenity provision – their staff are really happy here and we’ve had an ongoing partnership with them.

“As a long-term owner of our assets, the ability to enable companies to scale here is hugely significant.”

right product, right time

For Tarun, the recent leasing successes are a combination of providing the right product and doing it in the right place.

He said: “Firstly the building has to work – value and workplace environment are key. In the case of Zopa, which is moving to Wood Wharf’s 20 Water Street, the bank found it really appealing.

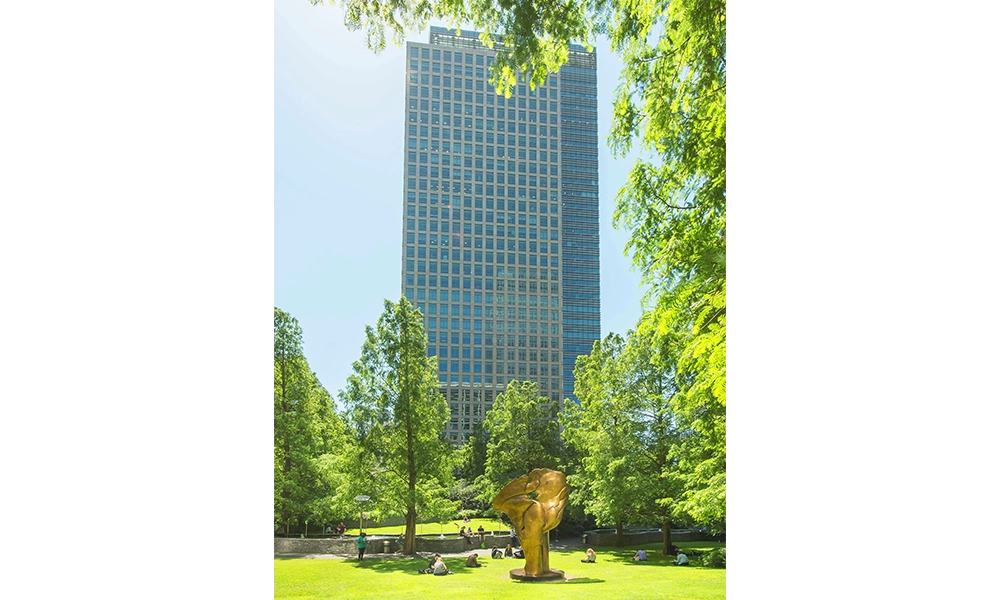

“Businesses are now thinking about their workplace, not just within the four walls, but also the micro environment and how their employees can benefit from the ecosystem of Canary Wharf.

“The blue and green spaces we have here are as good as anywhere in London and then there’s the access to local amenities. As a package, occupiers are seeing that as immensely valuable.

“The Elizabeth Line is also a game-changer.

“It creates additional capacity alongside the Jubilee line and the DLR, as well as resilience.

“There’s been a bit of a time-lag, but the real estate office market is now benefiting from it as those advantages filter up to the level where occupiers make decisions and those claims are backed up by our footfall numbers.

“In 2024, 72million people came to Canary Wharf – that’s a stratospheric increase on 2019 and it’s a figure that’s forecast to be exceeded in 2025.”

a wider appeal

Tarun said there were a number of factors that were making Canary Wharf attractive to companies at present, not least the wider regeneration of east London.

“For some businesses it’s about the fact that the capital is moving east, so there’s a large, younger pool of talent that they’re looking to target within the radius of the estate,” he said.

“It also goes back to what we’re delivering – a high quality product with the best workplace experience that meets the needs of our clients.

“There is constraint in the office market at the moment and that means organisations are having to be more open-minded about location.

“Some years ago, there was more of an insistence in some sectors that they stay as close to their existing buildings as possible.

“We’ve seen a slight shift in that this year because of supply and demand of Grade A products.

“It’s exciting for the future because our existing stock is filling up.

“Our current vacancy rate is around 6%.

“We were around 10% about 12 months ago, so it’s come down quite significantly.

“Right now, it’s all about the buildings we’re getting back and how we can reposition those products for the next-generation occupier, so that’s where our focus is and it’s really exciting.

“Then we’re looking at what we can do to integrate these towers better into the public realm than they were when they were designed 30 years ago.

“Back then occupiers wanted large, secure reception areas on the ground floor. Now they want them to be amenity rich with lots of vibrancy.

“Until you get the buildings back, there’s only so much you can do but our teams have done an amazing job activating the estate with arrivals such as the Troubadour Theatre coming later this year.

“I think in 10 years time we will see more permeability across the estate with links from building to building and a lot more engagement for workers, residents and visitors.

“The ongoing process of diversification will continue but we’ll stay true to ourselves – tapping into new markets.

“We’ll see growth in the technology sector here alongside life sciences and financial services.

“Canary Wharf is a place for everyone and we’re demonstrating that. It’s a long time since it was just a financial or business district.”

key details: commercial space available in Canary Wharf

Workspace at Canary Wharf is currently available at Level39, One Canada Square, 40 Bank Street, One Bank Street and The Columbus Building.

Find out more about the options here

Read more: Discover Greenwich Theatre’s revival of Jim Cartwright’s Two