Co-founder and director of the Level39-based company talks billing and climate change optimism

Subscribe to Wharf Life’s weekly newsletter here

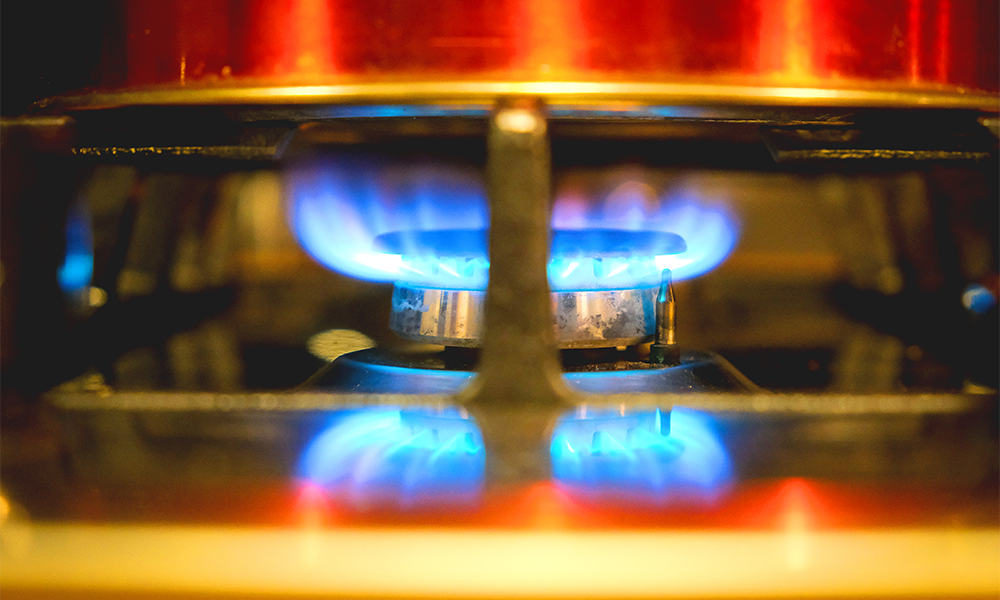

The topic of energy is seldom out of the news at present.

There’s the government plan to cap household bills at an average of £2,500 through 2023 with six months of equivalent support for businesses at a cost of more than £100billion.

Then there’s the longer term problem that, unless humanity brings down global carbon emissions by finding ways to generate the power we need in more environmentally friendly ways, then our activities on this planet will be the end of our species.

Whatever is going on in the market or with the planet, organisations’ ability to accurately know their own usage and impact is essential.

That’s where Utilidex comes in. Founded in 2012, the company is based at Level39, Canary Wharf’s tech community, spread across various floors of One Canada Square.

“We create software for businesses, the public sector and industry,” said co-founder and director Mike McCloskey.

“We do three things. Firstly, we do billing and, by default, bill validation for our customers.

“Secondly, we handle energy procurement – that means buying energy for the future for large corporates and industrials particularly.

“The reason we do that is so companies are less exposed to big changes in prices, to mitigate big shocks in the market.

“Then thirdly, from the data we receive, we create, assess and monitor the carbon footprint of an organisation based on the latest conversions.

“These actually change every year based on how much renewable energy is in the system.

“Once you have that data, which tends to be in half-hourly granularity in the UK, you can make observations – a business can monitor things like how much energy is being used when a property is vacant or a floor is empty in a building.

“You can work out things like energy intensity per square foot and then compare different buildings to see how they differ.

“That’s how you start to understand whether you’re wasting energy.

“Once you start looking at data in this highly granular form, then the observations become more interesting.

“These days, companies are devoting a bit more time to this – they are carbon aware – but even prior to that there was still a requirement for people working in facilities management to understand day-on-day, week-on-week, month-on-month, whether the organisation was making energy reductions and procuring power more effectively.

“These are the sorts of things we try to inform our customers about.

“With our software, it’s all about usability and understanding how the system works – getting as much benefit as you wish and deciding how much activity you can and want to devote to energy.

“In terms of value, we can measure the impact of projects and behavioural change – for example, swapping to LED light bulbs.

“The data can provide the justification for doing things like that.

“We also do the basic things like ensuring our customers’ bills are accurate.

“If your bill is £5million, then you’ll want to know if it’s correct or whether you’re under or over.

“It could be that a company is still being billed for a property it no longer owns, that the rates have changed or that the meter data is either not coming through or has been poorly estimated.

“There’s a lot of talk about energy suppliers over-billing, but in my experience, they’re just as likely to under-bill which is equally problematic if there’s a shock at the end of the year and it wasn’t in the budget.

“Traditionally much of this work was done manually, which was time consuming and prone to error, so we do it digitally.”

Utilidex, which has recently added water to the list of utilities its software supports, did not spring fully-formed from the minds of its founders – Mike and co-founder and CEO Richard Brys.

Instead it is a company where change and evolution have shaped its activities, growth and direction.

“When you start a business in the utility sector, especially if you’ve got some experience, you usually have a plan,” said Mike.

“But as the market evolves there has to be re-calibration and sometimes chucking everything out of the window and starting again.

“All these things happen in a dynamic fashion, but you have to adapt to those changes to stay in business.

“We were very lucky. Our first two corporate customers – Bourne Leisure and Aviva – had massive environmental awareness in 2014 and still do today.

“Their interest drove us into an area where we had to learn quite quickly what had to be done to support behavioural change in buildings.

“Nowadays, every organisation above a certain size in the UK has a carbon target.

“These are set at board level, so have to be adhered to, and there are lots of opportunities where our data can be used either by consultants, developers or sales providers to build a business case for a project.

“We want to build our business in the UK and grow it here – there’s a lot to do.”

One of the parts of its business Utilidex hopes to expand is the ways it supports organisations to reduce their carbon emissions.

“I’m actually more optimistic now about climate change than I was eight months ago,” said Mike.

“Sadly, that’s down to the rocketing energy prices.

“They will cause a dark winter where energy conservation becomes really important for financial survival, be that for households or businesses.

“The impact of this will accelerate the process because it will force everybody’s hands and that should be a good thing for the planet.”

While Mike said there were no easy fixes for businesses facing escalating bills, he said some would be in a position to take action.

“It’s a massive problem and will need to be addressed in a variety of ways,” he said.

“One way for organisations to do that is to become both producers and consumers of energy as well as investing in batteries to help avoid peak rate tariffs.

“Where firms have the capital, now would be a really good time to invest in wind or solar – and make their own energy. That’s the way industrials will need to go.

“It’s also good because it creates additionality as well – there’s one more solar panel or wind turbine generating power that can be used or fed back into the grid.”

Read more: How Third Space helps Wharfers make the most of their time

Read Wharf Life’s e-edition here

Subscribe to Wharf Life’s weekly newsletter here

- Jon Massey is co-founder and editorial director of Wharf Life and writes about a wide range of subjects in Canary Wharf, Docklands and east London - contact via jon.massey@wharf-life.com